During the last month I received a few emails from traders who are just getting started. They were happy with the advice I was providing but wanted to know some easy swing trading method for anyone to follow.

I decided to give specifics this time around, so that beginners can try and actually follow along with this trading method and hopefully will benefit from it. One of the first trading methods I learned was a simple channel breakout. What I like about channel breakouts is they are so simple to learn and it doesn’t take much to identify these channels.

The first thing you need to do is identify a channel. I will use daily charts to demonstrate this but you can apply this to any time frame you prefer. If you are applying it to intra-day charts and want to day trade using this method, that’s great but make sure you enter the trades no later than 1:00 after the opening bell, the reason for this is simple.

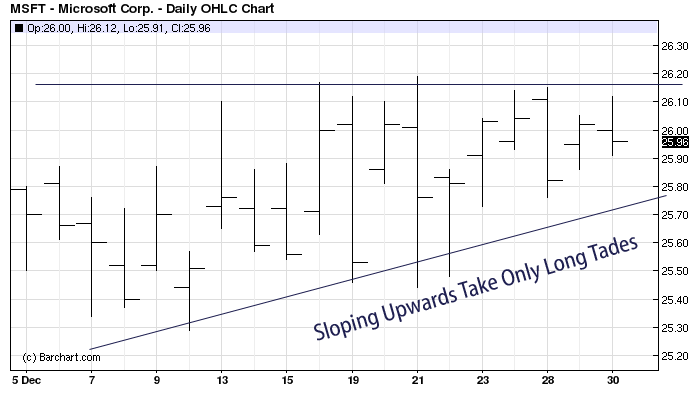

Day trades need time to work and if you limit your time too much your trade won’t have enough time to develop even if it’s going in your direction. Therefore, if you are not holding positions overnight I highly recommend you enter your intra-day orders as early as possible. The first step is to locate a market that’s trading in a trading range for the last 10 trading day or two weeks.

The tighter the channel the better the trade and the less risk you will have. Try to pick markets that are typically volatile but tend to quiet down during the trading range. If the trading is leaning up you only look for trades to the upside.

The Most Efficient Way to Find Options Trades

Those who trade options on a whim, with no rules and no plan, will become food for Wall Street, often blowing out their accounts within months. On the other hand, successful traders spend months, and sometimes years, mastering a few strategies before risking a dime in the markets.

Tap here to see a demo of a proven options strategy that leverages decades of data and statistics.

If the channel is slanted downwards, you should only take trades going down. Here is an example of what I mean. In the example below, Microsoft is in a trading range that lasts over 10 trading days. The slope is upwards so I will only look for trades going up.

Easy Swing Trading Method For Anyone

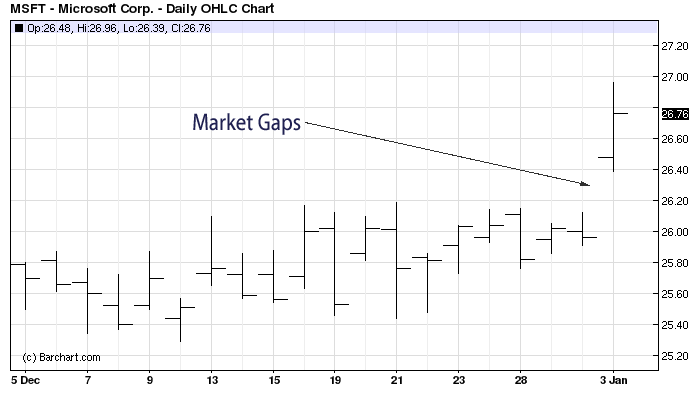

The second step is to wait for a gap going up. Remember you want to ignore all trades going short if your slope is upwards.

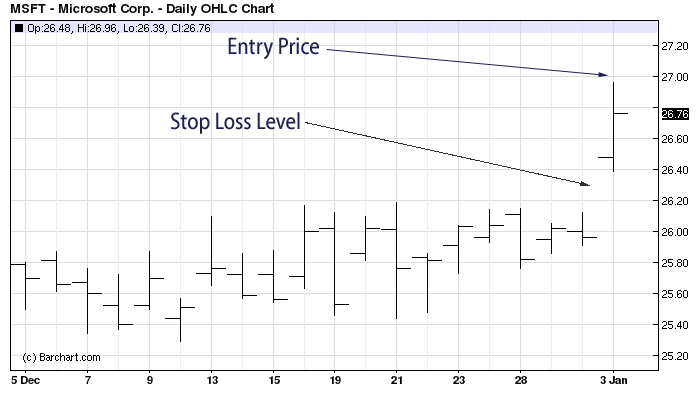

The next step is to place your order and your stop loss. The entry order is placed 2 ticks above the high made on gap day and the stop loss is placed 2 ticks below the low made on gap day, this is how it will look on the technical chart.

Don’t get nervous or stressed out if you don’t understand this. This is an easy swing trading method for anyone but if you are a beginner take it slowly in the beginning.

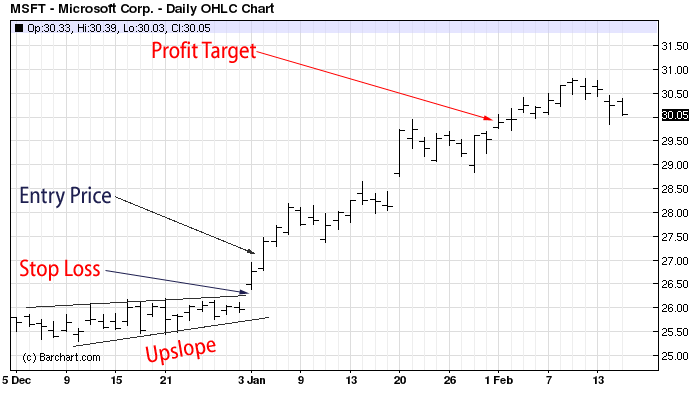

Once I enter the market and place my stop loss I need to figure out where to take profit. Take the distance between the entry price and the stop loss and multiply it by 4 and add that to your entry price. Since the difference between the high and low in this case is about 65 cents.

I add a few ticks for the entry and for the added two ticks for the stop loss and come out with $.70 cents. I then multiply this number by 4 and come up with $2.80 cents. Since I entered at $27.00 my exit target would be right around $29.80 cents. Let’s see how that looks on the chart.

You can see above, the entire sequence of events from analysis to exit point. This strategy is a simple channel strategy and is one easy swing trading method for anyone to learn. It works with all markets and time frames. If you want to trade this easy swing trading method for anyone to the short side just reverse the rules and make sure the upper channel line is sloping downwards.