Stocks and the Economy: Understanding the Wealth Effect on Consumer Spending

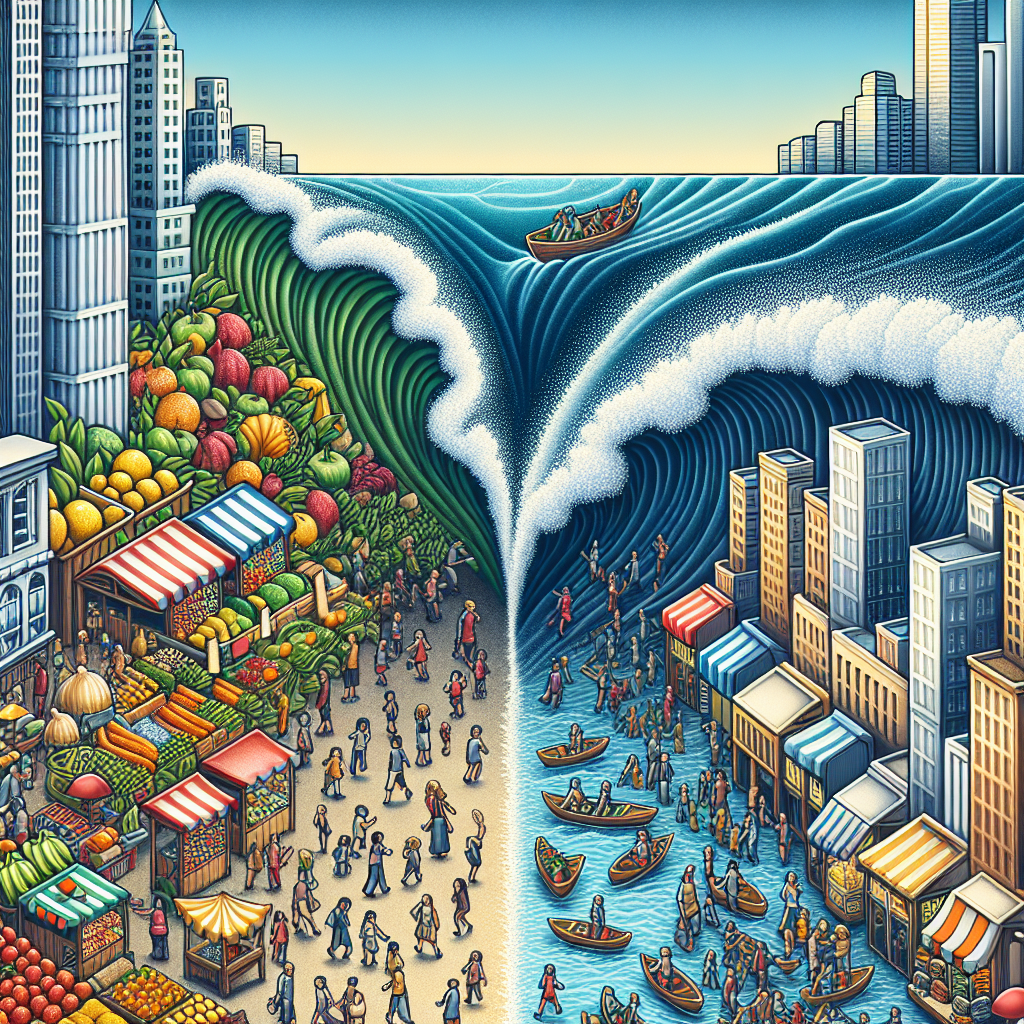

The phrase “the stock market isn’t the economy” has been a staple in economic discussions for years. However, recent findings from economists at Oxford Economics indicate that this old adage may need to be reassessed. According to their research, fluctuations in equities and financial assets are increasingly shaping consumer sentiment and spending behaviors, with significant implications for the economy at large.

The Wealth Effect Explained

The wealth effect is a concept in economics that suggests changes in perceived wealth—whether from financial assets or real estate—affect consumer spending levels. In a note published on Thursday, Bernard Yaros, the lead U.S. economist at Oxford Economics, elaborated on this phenomenon, asserting that the overall wealth effect associated with financial assets and real estate is now at an unprecedented level.

Yaros highlighted that households are amassing wealth at a rate surpassing that of previous economic expansions, contributing to a palpable boost in consumer spending. As households become wealthier, the increased confidence in their financial situation tends to result in more robust spending habits.

The Data Behind the Findings

Oxford Economics focused their attention on various financial assets, including stocks, bonds, mutual funds, cash, and pension entitlements, while also considering the role of housing wealth. Their analysis found a remarkable correlation between changes in financial wealth and consumer spending. Specifically, they estimated that for every 1% change in financial wealth, personal consumption expenditures (PCE) adjust by 0.14%. This equates to a 14-cent change in spending for every dollar change in financial wealth—an influential metric for understanding consumer behavior.

A Shift in Wealth Dynamics

Interestingly, the research revealed that wealth derived from the stock market now exerts a greater influence on consumer spending than housing wealth. Historical data indicated that housing wealth effects previously dominated before, during, and after the 2007-2009 financial crisis. However, as stock prices regained their losses post-crisis, financial wealth began to ascend, overtaking the housing wealth effects by 2014. This shift implies a growing consumer confidence in stock market wealth compared to real estate, as Yaros noted.

Market Fluctuations and Consumer Spending

Since the S&P 500 reached a record close on February 19, stock prices have seen notable declines, entering correction territory defined by a drop of 10% from recent highs. Oxford Economics analyzed potential scenarios indicating that should the market retract further to a 20% decline—a bear market—it would result in a reduction of 0.3 percentage points in personal consumption expenditures this year.

While this may seem minor, Yaros pointed out that certain areas of consumer spending would experience more pronounced effects. For instance, categories like recreational goods, vehicle purchases, travel, dining, and hospitality would likely face significant drawbacks due to the negative wealth effect stemming from lower stock prices.

Consumer Sentiment and Its Vulnerabilities

The current landscape also reveals frailty in consumer sentiment, particularly influenced by uncertainties surrounding fiscal policies, such as President Donald Trump’s tariff plans. This backdrop heightens the vulnerability of discretionary spending, creating a “potential double whammy of lower stock prices and brittle sentiment,” as quoted by Yaros.

Generational Wealth Dynamics

Contributing to the dynamics of the wealth effect is the growing demographic of retirees who, unlike younger generations, no longer earn income from employment yet possess higher net worth. This trend underscores the increasing importance of financial wealth, as many individuals now form their perceptions of the economy largely through the lens of the stock market rather than the housing market.

Conclusion

In conclusion, while the distinction between the stock market and the economy remains an essential perspective, the insights from Oxford Economics compel us to consider the profound connection between financial wealth and consumer sentiment. As households continue to accumulate wealth, the implications for spending behaviors could be significant, impacting various sectors as they navigate market fluctuations. As we move forward, understanding these dynamics will be paramount for anticipating shifts in consumer spending and economic health.