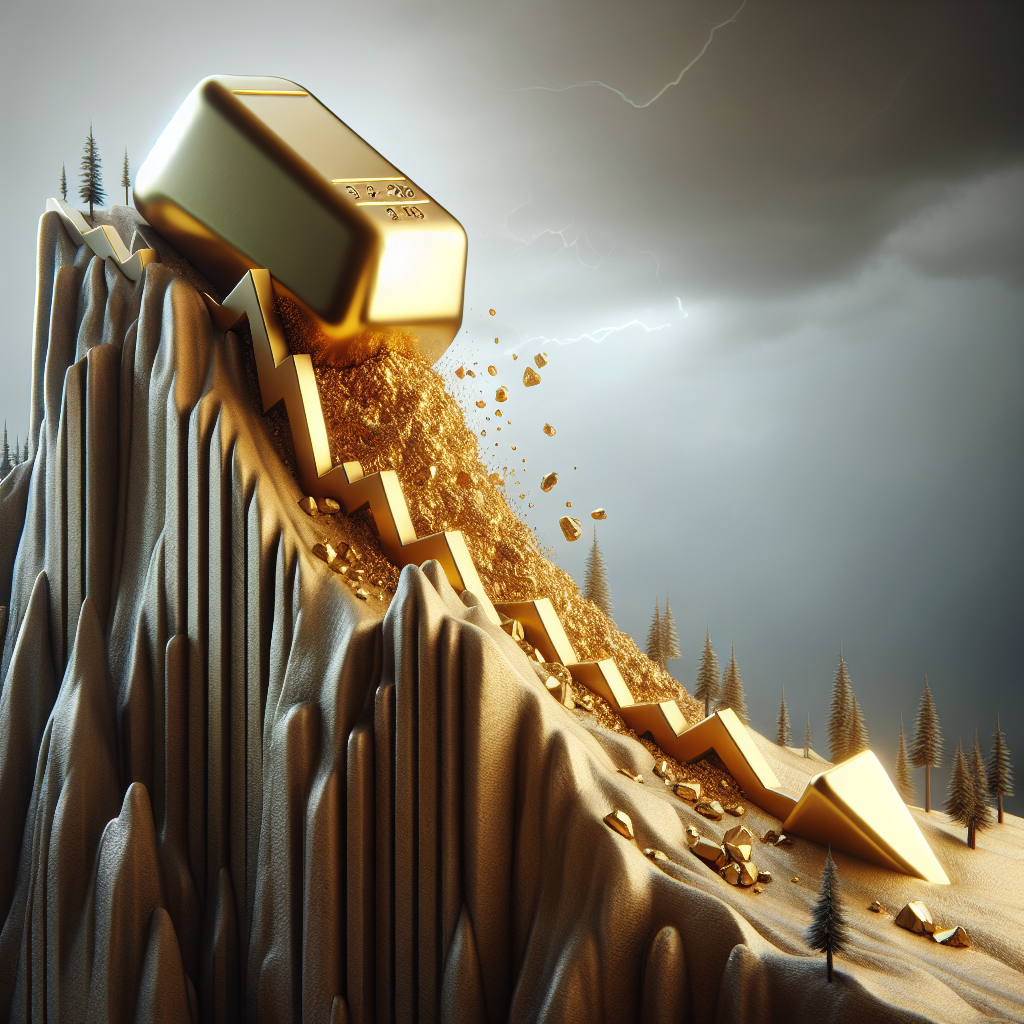

Why You Can Expect Below-Average Returns from Gold in Coming Years

As gold (GC00) approaches the critical price threshold of $3,000 an ounce, recent research suggests that investors should brace for below-average returns in the foreseeable future. White hot inflation and speculative economic conditions have propelled gold prices, but experts are signaling caution based on historical data regarding gold’s performance against inflation.

The Insights from Campbell Harvey and Claude Erb

Research from Campbell Harvey, a finance professor at Duke University, and Claude Erb, a former commodity-fund manager at TCW, underpins these findings. Their work, particularly the 2012 study titled “The Golden Dilemma,” highlighted a critical metric: the ratio of gold’s price to the U.S. consumer-price index (CPI). At the time of their analysis in 2012, this ratio stood at approximately 7-to-1, double its historical average. Following their predictions, the price of gold plummeted by 50% over the subsequent three years.

Currently, the ratio is even higher—around 9-to-1—indicating that the historical precedent may repeat, with gold likely to lag behind inflation and provide less than stellar returns for investors. Harvey stresses that following past peaks in gold prices, real returns over the next five to ten years have often turned negative. “We are in a ‘risk on’ environment, and ‘risk on’ is great for investors until it isn’t,” he cautions. “Investors beware.”

Gold’s Fair Value and Market Dynamics

The core idea behind Harvey and Erb’s model for estimating gold’s fair value involves the principle of mean reversion. When gold’s price relative to CPI is above its historical average, as it is now, the expectation is that gold will underperform in the years that follow. In contrast, when the ratio dips below the average, it suggests that gold can outperform inflation. Over the last two decades, gold has managed to outperform inflation; however, the previous two decades presented a different story, with gold failing to keep pace.

The research also reveals an important perspective regarding gold as an inflation hedge. Many proponents argue that gold prices should closely mirror inflation rates, but this is not the case. Historical data shows that gold prices can fluctuate wildly in relation to inflation, indicating that while gold may hold value as a store of wealth over a century, it does not provide reliable inflation protection in shorter increments.

Challenges to the Gold Investment Thesis

Among the arguments made for a resurgent gold market is the notion that it serves as a hedge against geopolitical risks. Given the current global climate, this assertion appears compelling. However, Harvey and Erb’s research challenges this notion, pointing out that during periods of significant stock market decline, gold has displayed a mixed performance, neither consistently gaining nor losing value. Their analysis shows an equal division between months when gold gained and lost value amid market turbulence since the 1970s.

While recent performance may have favored gold, experts remain skeptical about its ability to continue this trend in the near future.

Conclusion: Caution Ahead for Gold Investors

The outlook for gold in the coming years paints a picture of caution. The historical data indicates that when gold prices reach new highs, the likelihood of negative returns rises significantly. Investors should remain vigilant, considering not just the immediate allure of gold but also the long-term implications of current valuations. Without a substantial change in economic conditions or shifts in investment sentiment, the odds of gold maintaining its current high are not in its favor.

As the investment landscape continues to evolve, being informed by reputable research such as that conducted by Harvey and Erb becomes pivotal for making sound investment decisions regarding gold.