Welcome to TheoTrade®. Before we dive head-on into Selling Vertical Spreads for Income, it is imperative to set the trade stage with the proper approach and logic of your trading strategies. The following are key components of TheoTrade’s principles and should be strongly considered prior to entering into a trade or investment.

TheoTrade Principles

1. Trade Logic

2. Capital Allocation

3. Directional Bias

- Trade Logic. At TheoTrade we put your strategy and trade logic first. The vast majority of people involved in markets are infatuated with market direction, attempting to predict the next move a stock is going to make. In reality, what you “think” a stock is going to do does not always translate into profits. Many investors and traders alike place far too much emphasis on being right or picking the next move a stock might make. Our veteran traders dictate the right strategy coupled with established entry and exit criteria. You do not need to be “right” in picking a direction in a stock or the markets in order to be profitable.

- Capital Allocation. How and where you allocate capital should be strongly considered as a viable portion of your trading methodology. At TheoTrade, capital allocation takes precedence over being “right” in the markets. Why, you ask? Experience and watching order flow for decades has taught us invaluable lessons. Have you ever been stopped out of a trade or bailed out of a position only to see the markets turn around shortly thereafter? How and where you allocate capital can define not only losses but it can be the defining factor in your overall success or failure in the markets. Our war cry is “duration over direction”, you need to be capable of sustaining trades long enough to be profitable.

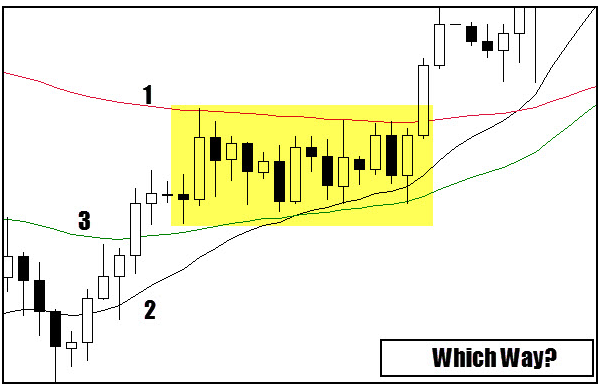

- Directional Bias. We are not anti-charts. Rather we recognize where you “think” a stock might go does not always mean the markets will agree with your sentiments. Being right directionally cannot define us as investors or traders for we may not be “right” often enough. At TheoTrade we are realists of the marketplace and we must place our capital at risk ONLY with the correct trade logic and a comfortable allocation.

Short Vertical Spreads

The most important and sound method of looking at a vertical spread is from the viewpoint of probabilities. All trading strategies and logic need to account for all possible outcomes. Examining outcomes will help a trader determine a price at which a vertical spread must be sold in order to make a profit. However, a diligent trader must also recognize and offset losing trades,, for winning trades alone DOES NOT make traders profitable in the long run. A winning streak one receives when selling vertical spreads means little or nothing and without adequate principles will be short lived.

Theory Behind Vertical Spreads

Probabilities are a fact of life. The second we are born the nurses weigh us, measure our length and assign an Apgar score to group us into certain categorical components that allow the doctor to make statistical assumptions about our physical health. Car insurance, mortality rates, point spreads in sporting events all use probabilities to make an educated guess/approximation of what to expect under certain circumstances. Insurance companies make and lose great deals of money based on when you die compared to the mean (average) age of death for a male or female. Vertical call and put spreads are no different.

Assume that we sell an October 60-55 put vertical spread at $1.50 in stock ABC trading at $60 per share. Will we make money? Your initial thought is to ask, “is the stock in a bull or bear trend?” In trading we must account for all outcomes; therefore, the trend will end 50% of the time once you identify it to be a trend and act on it. In the TheoTrade aforementioned principles, please recall, “Being right directionally cannot define us as investors or traders for we may not be right often enough.”

A more simple question would be to first ask, “What is the likelihood that the stock is going to be above (our winning area) or below (our losing area) $60 at some point in the future?” We all know, even if we don't believe it, that the answer is 50% of the time the stock will be above $60. That means that roughly 50% of the time the stock will be below $60, resulting in us giving back some, if not all or more, of the premiums received when we sold the spread.

Now, with this said, what is the amount that we should receive for the sale of the call spread to be a fairly priced trade? Our first instinct may be to say, “Since the vertical spread we are looking to sell is a $5 spread; and since we can lose $5 on a $5 spread; and since the stock will go down about 50% of the time; thus, we must get at least 50% of the $5 (or $2.50) for the spread to be fairly priced”. CLOSE – BUT NO CIGAR!

One must remember what the statement “50% of the time the stock will be above $60” means. Certainly it has been displayed that half the time an underlying will rise, and the other half of the time it will fall. This, however, does not say ANYTHING about the extent to which it can move. Or stated another way, if the stock is below $60, thus resulting in a potential loss on the sale of the vertical put spread, it could be $0.10 below $60 (at $59.90) or $20 below $60 (at $40). At either price the statement is true.

Many factors play a crucial role in predicting what we can expect a stock’s movement is likely to be. Seasonality, time until expiration (the more time – the more the stock is likely to move), geopolitical events, the economy, and volatility (as well as many other factors) all have an integral impact on how much ABC is likely to move beyond what direction it is going to move.

Should the stock ABC move against us, but by a small amount of say $0.10, the vertical spread would be a winner provided we sold it for anything more than $0.10, even though the stock went in the wrong direction. Had we received $5 for the sale of the vertical spread when we sold it, there is no way we can lose money. The worst that could happen is the stock moves against us in a large dollar move to the point where the spread is worth $5 at expiration, and we therefore have to give back all we have originally collected.

As this exaggerated example shows us, the amount we receive is very important in predicting our success on the trade. The more we sell a spread for, the more of a “buffer” we have against loss.

Another way of looking at this is from the reverse perspective of what we are doing (selling the spread) from the perspective of the buyer. Let us evaluate two different spreads using TheoTrade logic to see which the better candidate for purchase is. Movement will likely be the determining factor. Take a look at the two spreads below.

All other variables being equal, it is evident that the purchase of the ABC spread is the better of the two. If for no other reason than the individual who purchases the XYZ spread can’t have any reasonable expectation (based on the past) of ever making money on a long put spread with the long put (the put purchased) being at the 60-strike. Based on the stock’s history from last month, in which it had a $2 range with a low of $59, the long put spread is unlikely to make any significant amount of money. Should the stock sell off to reach last month’s lows ($59), the 60-55 put vertical spread (long the 60 put—short the 55 put) will have $1 of intrinsic value at expiration. Since the spread sale resulted in a credit of $1.50 to initiate, the net result will be a $0.50 per share loss ($1.50 credit from sale - $1.00 intrinsic value given back as the 60-put sold is $1 ITM = $0.50 loss).

Even if the stock moves the full amount of last month’s range of $2 ($61 high - $59 low) to the downside, that would put the stock at $58. With the stock at $58 on expiration, the 60-55 put spread would only be worth $2 intrinsically, thus resulting in a profit of $0.50, or +33%. Now a 33% return is not horrific compared to expected annualized returns of 8% when owning a diversified portfolio; however, it is far inferior to the vertical spread in ABC.

Do not get confused with this example. It may seem logical to think that since ABC can move so far up, given last month’s performance of a high of $80, that a put spread would certainly be a loss in that direction, especially seeing that stock XYZ reasonably can only get up to $61 should the stock run up, that the ABC spread may be better. This is not true, in that the XYZ spread at its full range of profitability in our favor (down) reasonably could only expect a profit of $0.50 when the stock closed at a new low of $58.

Yet, the ABC spread needs to only see the stock get as low as $55 per share for us to make the maximum on the spread. Since last month the stock got as low as $39 a share, it is not at all difficult to assume that the stock can get down to a place where we will make the maximum on the spread, that being $55.

In an additional example, assume there are only two possible prices for each stock at expiration, that of its high or its low. Which spread would you rather own IF IT WERE FREE, knowing that each stock can only close at either its high or low for last month? The math below should answer that for you in a way that is likely more obvious than it was minutes earlier.

Looking above it becomes clearer which of the spreads is the preferable one to own, especially if it were free. As only two possible scenarios at expiration make it easier to understand, we will look at them both.

Stock Goes Up

Using the example of the stock moving up first, we see that both spreads are equivalent. It doesn’t matter if the stock closes at $61, $80 or $300, the put spread is still going to go out worthless, resulting in a complete loss of the investment. Thus, both spreads are equivalent should the stock increase in value between the time it was initiated and that of expiration.

Stock Goes Down

Should the stock decline in price to the only possible downward closing price, it becomes clear which of the two is the preferable spread to own, whether it is free or costs us the $1.50. Stock ABC will be worth the maximum it can be worth on the downside, whereas, stock XYZ will still result in a loss. XYZ’s loss is a result of the stock going down, but not down enough to offset the cost of premiums invested at the time of purchase.

Overview of Comparison

As is evident from above, it doesn’t matter what the stock does as each spread, in the worst scenario, is equivalent in loss. On the other hand, if you were correct in the predication market direction (down) for each stock, the former (ABC) will result in a profit whereas the other (XYZ) will result in a loss. The determining factor in how much to pay when buying a spread, or how much you will want to receive when selling the spread, is based primarily on how volatile the stock is. The more the stock is capable of moving in either direction will determine, to a large extent, what the spread is worth. The more the stock can move, the higher the price of the spread. It is the same thing as if you own earthquake insurance. The higher the likelihood of your house moving (California San Andreas Fault vs. Hartford, Connecticut), the more your insurance is likely to cost.

Summary

What it all comes down to is probabilities. Since a stock that can move more has a greater chance of moving in the direction we want, we are willing to pay more for it than for a stock that isn’t moving enough to likely make us a profit. So what is the mathematical probability of ABC or XYZ closing at $55 or lower so that we can make the maximum on the spread? Or, what is the likelihood that the stocks can get down to $58.50, a place where we break even on the trade? We have no idea (yet), but whatever that number is, it will likely tell us how much the spread is worth.

Simplified Example of Probability With Balls

Suppose you were involved in an office lottery pool but only four people were playing, and someone has to win the $100 prize. Every contestant pulls a ball out of a bucket containing three black balls and one white ball. Whoever gets the white ball gets the $100 prize, and the three contestants who got black balls lose their wager. What is the most you would pay to get into this office pool? Would you pay $10? $20? $40?

Obviously the correct answer to the question is anything up to $25. As there are only four possible winners, someone has to win, and each has an equal chance of pulling the white ball out of the bucket, each ball has a theoretical value of $25. Or, if you were the only player and bought all four balls chances for $25 each, you would be assured of getting your money back.

If the ball game is organized and selling each chance at $20 per ball, you could go out and buy all four balls for $80 ($20 a ball X 4 balls = $80), and be assured the $100 prize, thus netting a $20 profit without risk.

Simplified Example of Probability with Vertical Spreads

Let’s expand this example to include making some real money by trading vertical spreads. We saw earlier that the XYZ 60-55 put spread could at best be worth $1.00 at expiration, but cost $1.50 initiate. Thus, the absolute best that we could expect is to lose $0.50, and could just as likely lose $1.50. So, does paying $1.50 for the XYZ spread make reasonable sense? Obviously not. But what constitutes a bad purchase almost always constitutes a good sale.

If buying the spread can at best result in a loss of $0.50, then the individual who sold the spread will likely make at least $0.50 every time he/she sells this spread under these conditions. And if the stock stays in the same spot, or goes higher, he/she will make the full $1.50 he sold the spread for!

This, albeit an extreme example, is the thought pattern we will undertake to initiate the sale of a short spread. As stated earlier, the mathematical concepts behind pricing out a short vertical spread are far more complicated (as the stock has a wide variety of possible closing prices) than the bucket of four balls example. TheoTrade has developed detailed entry and exit criteria (a recipe) for selling vertical spreads using probability and outcomes to determine expected returns.

THE SPECIAL OFFER

TotalTheo®

Learn how the markets really work from veteran traders with 15+ years experience trading for income. TotalTheo is a unique, all inclusive trading subscription for stock, options, and futures traders. Included with TotalTheo:

- TheoNight® Video Newsletter - Dissect the Anatomy of the Markets Each Night ($50 Value);

- TheoChat® - Real Trade Ideas and Real-Time Market Insights ($150 Value);

- TheoClass® - Monthly Class on a Host of Topics Ranging from Stocks, Options and Futures ($100 Value);

- TheoCoach® - Daily Coaching Sessions with Timely Topics on Verticals, Volatility, Scalping, and more ($50 Value);

TheoEvening® - Weekly Evening Coaching Session on Swing Trading, Portfolio Management, Hedging, and More ($50 Value);

TheoArchive® - Missed something we said? Find it all in Your Membership Portal, and Instantly Replay and View Every Second ($100 Value).

Other firms will charge at least $500/month to get everything TotalTheo® includes. At TheoTrade® the regular rate is $150/month. As a thank you for reading this chapter you can lock in 33% off the regular rate for life by clicking the image below:

ABOUT THE AUTHOR

Don Kaufman is one of the industry’s leading financial strategists and educational authorities. With 18 years of financial industry experience, Mr. Kaufman oversees TheoTrade’s firm-wide strategy and deployment initiatives, while designing and executing upon innovative content in the financial education space.

Prior to TheoTrade, Mr. Kaufman spent six years at TD Ameritrade® as Director of the Trader Group. At TD Ameritrade Mr. Kaufman handled thinkorswim® content and client education which included the design, build, and execution of what has become the industry standard in financial education. He started his career at thinkorswim® in 2000 (acquired by TD Ameritrade® in 2009), where he served as chief derivatives instructor, helping the firm progress into the industry leader in retail options trading and investor education services.

Specialties: Equities, Options, Futures, Currencies, Risk Management, Financial Modeling, Technical Analysis, Volatility and Derivative Pricing, Market Making.